What Is Enterprise Value (EV)? Importance & How to Calculate

Understanding Enterprise Value (EV) – The Complete Guide

When evaluating a company, investors and analysts don’t just look at its stock price or market capitalization—they consider its Enterprise Value (EV). EV gives a more complete picture of a company’s true worth by factoring in its debt, cash, and equity value.

If you’re an entrepreneur, business owner, or investor, understanding Enterprise Value can help you make better financial decisions, whether you’re buying, selling, or valuing a company.

What Is Enterprise Value?

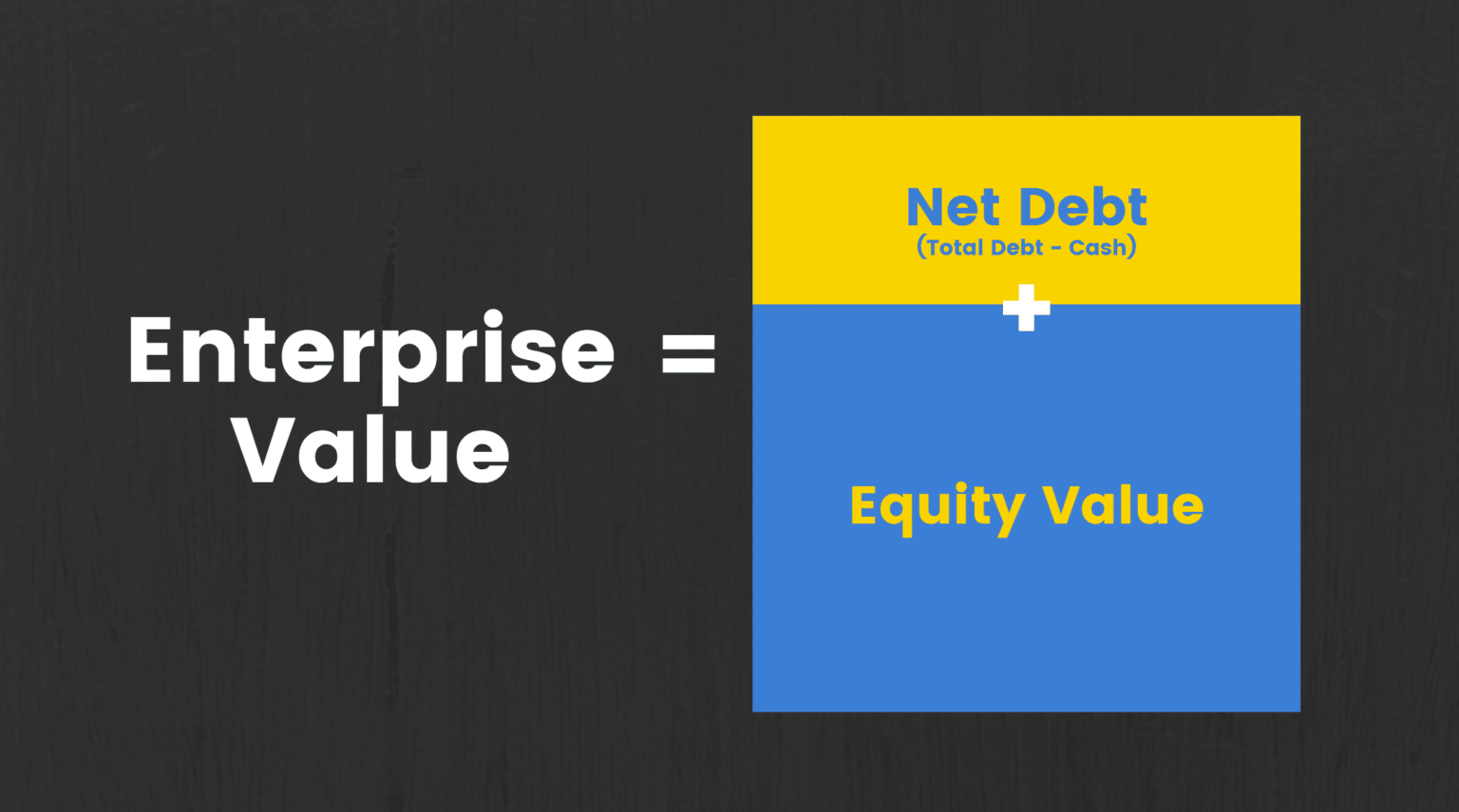

Enterprise Value (EV) represents the total value of a company, including both equity (ownership) and debt (liabilities). It helps investors see what a company is worth as a whole, rather than just the stock price.

Formula to calculate Enterprise Value:

EV = Market Capitalization + Total Debt – Cash & Cash Equivalents

Let’s break it down:

- Market Capitalization: The total value of a company’s outstanding shares (stock price × total shares).

- Total Debt: The company’s short-term and long-term liabilities, including loans and bonds.

- Cash & Cash Equivalents: The money a company has in its accounts that can be used to pay off debt.

By including debt and cash, EV gives a more accurate financial picture than just looking at market cap alone.

Why Is Enterprise Value Important?

EV is a crucial metric because it shows the true cost of acquiring a company. Unlike market capitalization, which only considers stockholders, EV includes debt, meaning it reflects the company’s full financial structure.

Key reasons why businesses use EV:

✅ Better valuation for acquisitions – If you want to buy a company, you need to pay off its debt too. EV shows the total cost.

✅ More accurate than market cap – A company with high debt but a low stock price might seem cheap, but its EV tells the full story.

✅ Useful for comparing companies – EV helps compare companies of different sizes, even those with different capital structures.

How to Calculate Enterprise Value – A Simple Example

Let’s say a company has:

- Market Cap: $50M

- Debt: $20M

- Cash: $5M

The Enterprise Value would be:

This means if someone wanted to buy the company, the real cost would be $65M, not just the $50M market cap.

Enterprise Value vs. Equity Value – What's the Difference?

| Enterprise Value (EV) |

Equity Value |

| Includes debt & cash | Only includes shareholder value |

| Shows total business value | Shows ownership value for shareholders |

| Used for mergers & acquisitions | Used for stock market valuations |

Can Enterprise Value be less than Equity Value?

Yes, if a company has zero debt and lots of cash, the EV could be lower than its equity value. This usually happens with highly cash-rich companies.

Enterprise Value Multiples – A Key Financial Metric

EV is often compared to revenues or earnings to assess a company’s valuation. A common ratio is:

A lower EV/Sales ratio might indicate an undervalued company, while a high ratio could mean the company is expensive.

FAQ

Why do businesses deduct cash from Enterprise Value?

Cash reduces EV because it’s an asset that offsets debt. If a company has a lot of cash, it means a buyer would “inherit” it, reducing the actual cost of acquisition.

Why do businesses add debt to Enterprise Value?

Debt is a financial obligation, and when buying a company, the buyer takes on this debt. That’s why EV includes all liabilities.

Can Enterprise Value be less than Equity Value?

Yes, if a company has no debt and lots of cash, EV can be lower than its equity value.

Why do businesses use Enterprise Value?

EV gives a full financial picture and is essential for mergers, acquisitions, and financial analysis. It’s more reliable than market capitalization alone.

Final Thoughts: Why Enterprise Value Matters

Enterprise Value is one of the most important financial metrics for investors, business owners, and entrepreneurs. Whether you’re valuing a startup, preparing for an acquisition, or simply trying to understand your company’s true worth, knowing how to calculate and interpret EV can give you an edge.

By considering debt, cash, and equity together, EV provides a realistic and comprehensive view of a company’s financial health.

If you’re in business, finance, or investing, mastering Enterprise Value is a must.

Need More Insights?

At Xaviour Holding, we help businesses understand and apply financial strategies that create real value. Stay informed and stay ahead.

🔹 Key Takeaways

✔ Enterprise Value (EV) = Market Cap + Debt – Cash

✔ Shows the real worth of a company, not just its stock price

✔ Essential for M&A, investment decisions, and financial analysis

✔ Used to compare companies across different industries

0 Comments