Importing into Spain: Avoid These Mistakes

Why Importing into Spain Isn't What It Seems

Importing into Spain has become a minefield, not because of laws alone, but because of how they’re enforced.

Behind the scenes, a network of Spanish customs brokers, courier companies, and opaque bureaucracy profit from complexity.

From inflated DUA charges to arbitrary courier markups, businesses are often left paying for inefficiency disguised as regulation. If you’re importing into Spain, understand this: it’s not just about documentation, it’s about navigating a system designed to slow you down—unless you pay up.

This guide isn’t about repeating what every government site says. It’s about decoding the real system, where NIE bottlenecks and courier fees reveal deeper patterns of inefficiency and giving you tools to operate with strategy, not frustration.

Want to avoid these traps altogether? Start with a focused customs audit through our Market Entry & Expansion service.

Our team will pinpoint inefficiencies, clarify documentation, and help you avoid hidden costs before they escalate

Understanding Spanish Customs

To navigate importing into Spain effectively, you need clarity on customs duties, import compliance, VAT, and the DUA form. Understanding the framework of EU trade regulations is also essential to reduce unpredictability.

- VAT (IVA in Spanish) is typically 21%, but this rate fluctuates depending on the type of product. For example, books are taxed at 4%, while hygiene products might still carry the full rate.

Meanwhile, items like supplements, cosmetics, or electronics often land in grey zones, left to the discretion of the customs agent.

This lack of predictability is not incidental. Customs employees are fully aware that a misclassified item could cost an importer an extra €30–50.

But they rarely clarify. Why? Because the cost of returning a package is even higher. Most importers simply absorb the inflated fees.

Delays in email replies are not accidental either. Time itself becomes a tax. As you wait for a clarification, storage fees accumulate, and your logistics chain suffers.

It’s no wonder people ask “Why is my package stuck in Spain customs?”

Documentation Pitfalls

Spain’s import bureaucracy is notorious for its inconsistency. While one shipment may pass without issue, another with identical paperwork may be flagged.

This variability creates confusion and adds to compliance fatigue.

Meeting Spanish import documentation requirements is an ongoing battle, what worked last month may fail this week.

In fact, many importers are forced to hire agents solely to interpret these shifting requirements, further driving up costs and uncertainty in the process.

Key Identification Numbers

Real example:

A €3 item was declared correctly. Customs reclassified it to €40, added 21% VAT (€8.40). Cargos de aduana at €24.60, admin charges of €12.

Total: €75.

Multiply that across 50 units €3,750 in arbitrary import costs.

And your only options? Pay, or send it back and damage the supplier relationship. This is the cost of not controlling the Spain customs clearance process.

These delays, often wrapped in vague timelines, show how fragile the system is when escalation is needed.

No clear appeal. Just fees, friction, and fading leverage.

Some agents require a printed NIE document. Others accept a number by email. A third rejects both and demands a certified copy.

The Spanish import documentation requirements seem to depend more on who you ask than what the law states.

- The DUA form (Documento Único Administrativo) is essential for declaring non-EU imports and part of the Spain customs clearance process.

- Many issues stem from Spanish import documentation requirements, which remain opaque and inconsistently enforced.

- Failures in understanding import compliance, mishandling freight forwarding processes, or ignoring delivery risk exposure all lead to costly delays and inefficiencies.

Personal vs. Commercial Imports

Commercial shipments are subject to tighter controls and higher fees.

Using the correct paperwork helps prevent border clearance issues and unexpected import cost overruns. The best way to clear customs in Spain is often to preempt issues—not react to them.

How NIE Turns Into a Gatekeeping Mechanism

- NIE: Required for individuals.

- EORI: Required for companies and commercial imports.

The NIE (Número de Identificación de Extranjero) is technically simple: register interest, book an appointment, visit a local police station.

But in reality, public slots are booked out weeks in advance often by agents who resell them.

This artificial scarcity forces individuals to pay intermediaries to complete a task that should cost nothing. It’s bureaucracy-as-a-service.

Even when a parcel is shipped with your name, phone number, address, and NIE clearly labeled, customs may still request written confirmation and additional identification.

This is a deliberate delay mechanism. Once contact is made, fees begin to stack, often €30 or more, under loose categories like ‘processing’ or ‘storage’.

And if you delay even slightly in responding, expect those charges to rise within 24 to 48 hours.

The EORI Paradox

For EORI, it’s worse. There are two systems: one for EU operators, another for third-country senders.

Each is managed differently, lacks transparency, and offers no retry logic if you’re denied.

These inconsistencies reinforce ongoing customs delays in Spain.

In 2023, Spain ranked 46th out of 180 countries on the Corruption Perceptions Index (CPI), its worst position in over 30 years.

With a score of 56/100, this reinforces a broader narrative, many inefficiencies importers face aren’t merely bureaucratic, they reflect institutional vulnerability.

When corruption intersects with logistics, opacity becomes a revenue stream.

The inefficiencies mirror broader dysfunction. These aren’t just logistical failures they reflect how structural apathy in public systems echoes across both trade and education.

The consequences spill into customs delays in Spain and inconsistent processing logic. This is the same inertia we examined in our analysis of cultural complacency, where the roots of today’s broken systems stretch far deeper than customs protocols.

The results contribute to widespread navigating Spain’s import bureaucracy challenges and force importers to rely on working with Spanish customs brokers, just to avoid unnecessary shipment documentation friction.

In short, importing into Spain with the wrong ID or document format often triggers customs delays in Spain, unnecessary shipment documentation queries, and escalating import taxes and duties in Spain driven less by law, more by opportunism.

Add in border clearance issues and you’re paying to navigate a system built to make you fail.

These systemic issues highlight why importing into Spain continues to be one of the most convoluted entry points within the EU.

And people keep asking: Do I need a broker to import to Spain? More often than not yes.

Common Pitfalls and How to Avoid Them

One of the most common errors in importing into Spain is assuming the cost breakdowns are clear and justified. But when users get invoices filled with vague surcharges, it becomes evident that lack of transparency is a feature, not a bug. This problem ties directly to customs delays in Spain and distorted billing logic used by some operators.

Shifting Responsibility Between Couriers and Customs

Couriers like UPS, DHL, and FedEx often claim that extra charges are mandated by Spanish authorities. Meanwhile, customs insists those fees, like “presentation to customs” or handling surcharges—are initiated by the couriers themselves. This disconnect exposes the most misleading part of the Spain customs clearance process: the strategic ambiguity over who is actually charging you.

If these were truly legal requirements, why are they rare or absent in other countries? Norwegian customs, for instance, apply clear, capped duties with no hidden add-ons.

We believe the financial alignment tells the real story. It’s plausible that Spain imposes indirect administrative burdens on couriers—who then shift the costs to users. With margins tight, inventing a €20–€35 “processing fee” per shipment becomes less an exception, more a norm.

And here’s where the real tension lies: this isn’t just customs inefficiency, it’s embedded behavior. It’s why people search “How to avoid delays importing into Spain?”

Systemic Silence and Trade Consequences

Want clarity instead of confusion? Start with a strategic customs check—see how we simplify EU compliance. through strategic import setup.

The passivity toward systemic dysfunction starts early. As examined in our breakdown of Spain’s youth crisis, structural resignation is often ingrained before adulthood.

What frustrates most users isn’t simply the cost, it’s the total absence of accountability.

Major shipping firms are complicit through silence. Rather than advocate for transparent practices, they seem to prioritize regulatory appeasement over customer protection.

This isn’t just inefficiency, it’s a structural choice driven by misaligned incentives.

It’s also what keeps questions like how long does Spanish customs take? and what documents are required for Spain customs? as frustrating today as they were a decade ago.

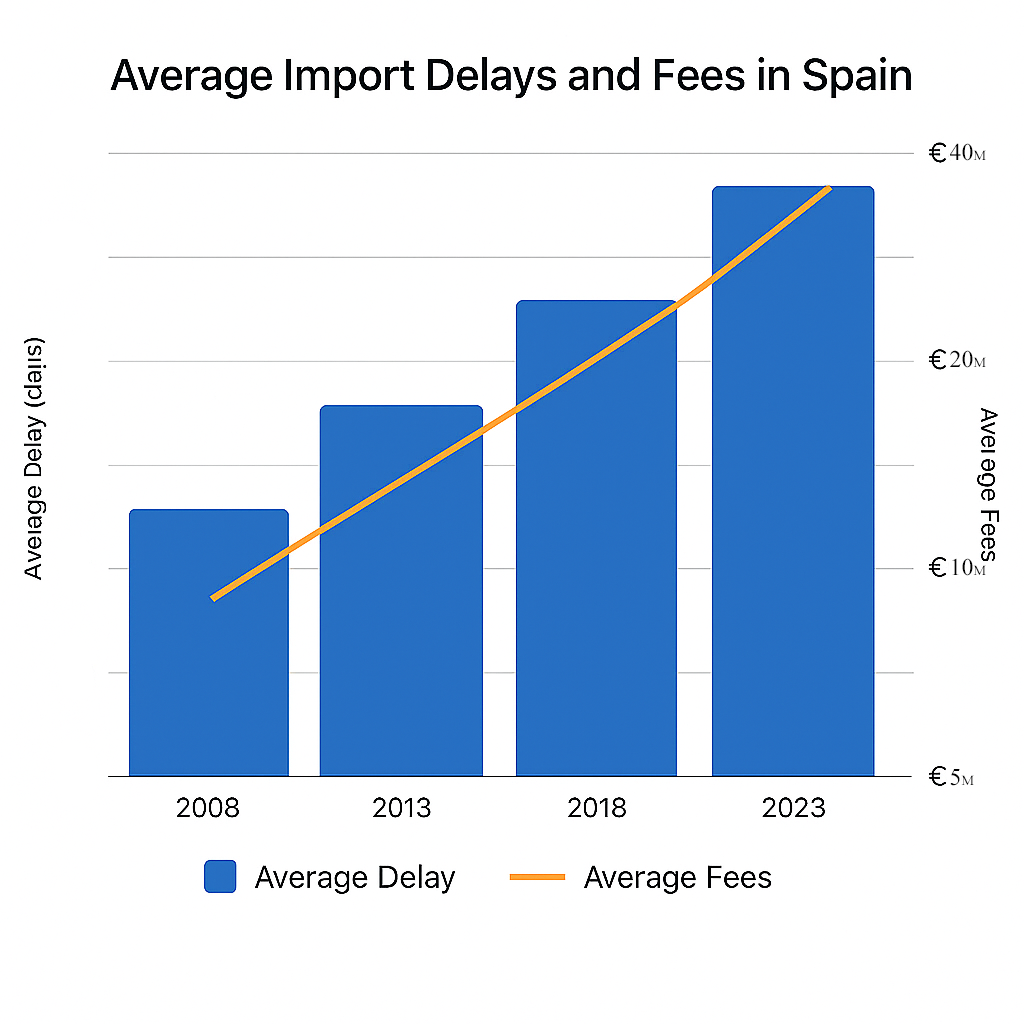

Visual breakdown of Spain’s customs processing patterns what happens before your parcel ever hits the port.

Final Take: Import Smarter, Not Slower

Importing into Spain is not a logistics issue, it’s a strategic one. To succeed, importers must anticipate Spanish import documentation requirements, respond proactively to customs delays in Spain, and account for unpredictable import taxes and duties in Spain that shift based on who’s processing, not what’s printed.

Within this uncertainty lies a single truth, power comes from preparation.

Understanding EU trade regulations, working closely with agents who know the system, and streamlining every document before it’s questioned will always cost less than reaction-based recovery.

And yes, Does Spain charge import fees on low-value goods? Far too often.

Shipping via experienced consolidators who provide door-to-door services can avoid customs altogether.

Though their base rates may be higher, these methods reduce risk, remove hidden fees, and ensure the product reaches your hands without delay.

For most clients, this is not only faster, it’s cheaper long-term.

Our advice? Don’t even order product samples directly. Route everything through structured backchannels.

Use honest, proven methods, but avoid unnecessary exposure.

Final Take: Import Smarter, Not Slower

Our advice? Don’t order product samples directly. Route everything through structured backchannels.

Use honest, proven methods, but avoid unnecessary exposure.

Importing into Spain is not a logistics issue, it’s a strategic one.

To succeed, importers must anticipate Spanish import documentation requirements, respond proactively to customs delays in Spain, and account for unpredictable import taxes and duties in Spain that shift based on who’s processing, not what’s printed.

Within this uncertainty lies a single truth: power comes from preparation.

Understanding EU trade regulations, working closely with agents who know the system, and streamlining every document before it’s questioned will always cost less than reaction-based recovery.

And yes: Does Spain charge import fees on low-value goods? Far too often.

Shipping via experienced consolidators who provide door-to-door services can avoid customs altogether.

Though their base rates may be higher, these methods reduce risk, remove hidden fees, and ensure the product reaches your hands without delay.

For most clients, this is not only faster it’s cheaper long-term.

Our advice? Don’t order product samples directly. Route everything through structured backchannels. Use honest, proven methods—but avoid unnecessary exposure.

0 Comments